Our Current Preferred Travel Insurance Vendor for Costa Rica!

The pandemic has created unique travel insurance requirements for Costa Rica. Our team and our clients have tested Trawick dozens of times over the past few months. We love them because it is SIMPLE, FAST and SUPER EASY.

We have had several of our clients tell us that our link provides better pricing than going direct to the Trawick site. Feel free to check, but we hope the green buttons below will provide you with the best price on trip insurance to Costa Rica.

Compare Quotes!

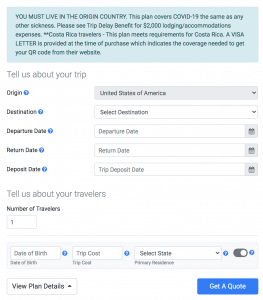

If you would like another quote to compare, you can fill out the blue quote box below for great options on trip insurance.

Both companies excel in travel insurance offerings.

Personal Touch!

Sometimes, you have circumstances that don’t fit into an online form, and you need and want more of a personal touch. Then Chubb insurance is the right choice for you. Give us a call or email and we can get you a quote from a company that excells in customer service. They will take care of you start to finish just like we do. Their claims process is smooth and you will always be working with a person rather than an informal online presence. If this is what you need, this is the insurance for you!

Costa Rica Travel Insurance

Why Buy International Travel Insurance?

- If you have to cancel your trip for a covered reason, travel insurance can reimburse you for your prepaid, non-refundable trip costs. Without insurance, you could lose your vacation investment.

- If you experience a covered medical emergency, travel insurance can help ensure you get high-quality care and reimburse you for covered medical costs. Without insurance, you may have to pay out of pocket when traveling overseas.

- If you have a covered travel delay, travel insurance can reimburse you for necessary, eligible expenses like hotels and meals. Without insurance, delays can be expensive.

- If you face an unexpected crisis, travel insurance gives you access to 24-Hour Hotline Assistance for expert help and advice. Without insurance, you’re on your own.

We've Partnered with Three Great Insurance Companies. Trawick, Allianz and Chubb Insurance

There are lots of international travel insurance providers. You are certainly not limited to these companies. They are simply providers that we and our customers have had great experiences with. We like these providers because of what they cover, their straightforward benefits, and simple online claim processing.

Trawick Insurance has a great policy that excels in providing Covid coverage while in Costa Rica. We recommend the Voyager Plan and can access it from this link. If you only want Covid insurance, put your trip costs to zero. if you would like additional costs for flights, cancellation or delays, put your actual trip costs. Be sure to list each family member individually. They also have an Explorer Plan that has reduced cost and coverage but is still an excellent plan. Please choose a plan that has the coverage you are looking for.

Allianz Global Assistance is used by over 40 million travelers annually. 84% of customers give them a 5-star rating, according to Trustpilot. They do a fantastic job of digitizing the process and making it easy. (You can get a quote in just a few minutes by filling out the form on the left.)

Chubb Insurance is one of the largest providers in the world and you can still call them direct on the phone, 24 hours a day and talk to someone in the US who knows what they are doing and can help. If there is an issue, we also have direct lines to our rep and can help communicate with their team if needed. If you’d like a quote from Chubb, just let us know and we’ll send in a request on your behalf. (It takes us about 2 minutes.)

These companies are great, have comparable prices. One is a bit more tech friendly than the other. One is more “work with a live person”. Each have different levels of protection you can buy. However, it is wise to spend a few hundred dollars extra just in case someone gets sick, gets hurt, etc.

The cost of insurance is dependent on age, state you live in, travel dates, and trip costs. The deposit date only determines pre existing conditions should you have a claim. If you have a claim, they will ask for proof of payment on deposit date, usually on a bank statement.